Your Solution to Market Volatility

In the current investment landscape, the constant and often violent swings of the stock market can feel like an unending storm. Many investors find themselves anxious about the unpredictability of a portfolio composed purely of equities, as this instability can lead to reactive, emotionally-driven decisions that undermine long-term financial goals. Traditional wisdom often presents a simplified solution: simply add bonds to create a “safe haven” that automatically cushions against every market downturn.

However, the reality of the fixed-income market is far more complex than this common misconception suggests. Corporate bonds, in particular, come with their own set of intricate risks and are not always a perfect hedge against stock market volatility. An investor who relies on this outdated belief without a deeper understanding could be exposed to unexpected losses. This guide cuts through the noise and provides a strategic, purposeful framework for leveraging corporate bonds. It moves beyond common myths to empower an investor with the knowledge required to build a more resilient, income-producing portfolio and navigate the fixed-income market with confidence. The goal is not just to add bonds, but to add them with a clear, deliberate strategy.

The Seven Smart Strategies

- Secure a Predictable, Income-Generating Engine

- Preserve Your Capital & Cushion Against Market Downturns

- Achieve True Diversification Beyond Simple Stock-Bond Allocation

- Harness the Power of Credit Quality and Strategic Yield

- Master Your Exposure to Shifting Interest Rates

- Avoid Common Myths and Debunk Outdated Assumptions

- Build a Resilient, Long-Term Portfolio That Works for You

The Comprehensive Guide to Boosting Stability

1. Secure a Predictable, Income-Generating Engine

A corporate bond is a debt obligation, akin to an IOU. When an investor purchases a corporate bond, they are essentially lending money to the company that issued the bond. In return, the company makes a legal commitment to pay interest on the principal and, in most cases, to return the principal when the bond reaches its maturity date. This stands in stark contrast to stocks, which represent an ownership interest in a company. The debt-based nature of a bond provides a more predictable structure for returns, as the company is legally obligated to fulfill its payment commitments, unlike discretionary stock dividends.

The core appeal of corporate bonds lies in their capacity to provide a steady stream of income through what are known as coupon payments. These payments, typically made on a semi-annual basis, offer a predictable and regular source of cash flow. This characteristic makes corporate bonds a particularly appealing option for income-focused investors, such as retirees, who require consistent revenue to meet their living expenses. While the standard fixed-rate bond provides consistent coupon payments over its entire life, there are other structures that can serve different strategic needs. Floating-rate bonds, for example, have interest rates that adjust periodically based on a predetermined benchmark, which can provide protection against interest rate fluctuations. Conversely, zero-coupon bonds are sold at a deep discount to their face value and do not provide periodic interest payments. Instead, the investor receives a single, lump-sum payment at maturity, which is structured to result in a capital gain.

2. Preserve Your Capital & Cushion Against Market Downturns

Bonds are generally regarded as less volatile than stocks, and for a good reason. The value of a bond is tied to a fixed maturity date and a set par value, which offers a known return of principal. This inherent stability makes bonds an effective tool for capital preservation, especially when contrasted with the high volatility of stocks, which offer little to no downside protection.

A key strategy for preserving capital is holding an individual bond to its maturity date. By doing so, an investor can “look through” any short-term market price volatility. As long as the issuer does not default, the investor is guaranteed to receive their full principal back at maturity. A historical example of a Treasury note demonstrates this principle: its price can experience a “bumpy ride” along the way, but it will still mature at its par value, ensuring the principal is preserved.

However, there is a common misconception that holding a bond to maturity completely eliminates interest rate risk. This belief is an illusion. While it protects the nominal principal from market fluctuations, it does not safeguard against a decline in the real value of the investment. The true risk is not a loss of face value but rather the opportunity cost of being locked into a fixed, lower income stream if interest rates rise. If a bond pays a fixed 3% coupon while newer issues are paying 5%, the investor is losing out on a higher return. Furthermore, fixed income payments are vulnerable to inflation, which can steadily erode their purchasing power over time. A sophisticated approach considers the purpose of the portfolio: bonds should be viewed as the more stable portion, designed to keep pace with inflation and taxes, while providing the investor with the confidence to rebalance and acquire more stocks during market downturns.

3. Achieve True Diversification Beyond Simple Stock-Bond Allocation

Diversification is a core investment strategy designed to reduce risk by allocating capital across assets that react differently to market conditions. A widespread assumption in the investment community is that all bonds possess a negative correlation with stocks, meaning they rise in value when stocks decline. While this holds true for government bonds, the reality for corporate bonds is more nuanced. According to a research report from Morningstar, government bonds exhibit a negative correlation with equities, but corporate bonds do not.

This is a critical distinction to understand. Both corporate stocks and corporate bonds are fundamentally tied to the financial health of the issuing company and the broader economy. If the economy falters, corporate profits fall, harming stock values, while the risk of default rises, harming corporate bond values. While corporate bonds are far less volatile than stocks, their prices tend to move in the same general direction. For this reason, achieving true portfolio stability requires diversifying within the bond market itself. A well-rounded approach might combine government bonds for their negative correlation and “safe haven” qualities with corporate bonds for their higher yield and income potential.

Diversification within a bond portfolio can be achieved in three key ways: by bond type, by maturity, and by sector. Investors can choose from corporate, government, and municipal bonds, each with unique risk, return, and tax considerations. For example, the interest on municipal bonds is often exempt from federal, and in some cases state, taxes, which may make their lower yields more attractive than a taxable corporate bond’s yield.

A diversified portfolio should also contain bonds from different industries and economic sectors, such as industrials, financials, and utilities. This helps mitigate specific credit risk and sector-related price swings. For adequate diversification, it is often recommended to hold bonds from at least 10 different issuers.

|

Feature |

Corporate Bonds |

Government Bonds |

Municipal Bonds |

|---|---|---|---|

|

Issuer |

Corporations (public & private) |

National government (e.g., U.S. Treasury) |

State & local governments |

|

Typical Yield |

Higher returns |

Lower returns |

Lower yields (due to tax benefits) |

|

Credit Risk |

Higher default risk |

Minimal default risk (backed by government) |

Varies by issuer’s creditworthiness |

|

Tax Implications |

Interest is generally taxable as ordinary income |

Taxable; exempt from state & local taxes |

Interest is often tax-exempt at the federal level |

4. Harness the Power of Credit Quality and Strategic Yield

Credit ratings are a primary measure of a bond’s default risk. Independent rating agencies like Moody’s and Standard & Poor’s (S&P) assign these ratings based on their opinion of an issuer’s “ability and willingness to meet its financial obligations”. These ratings act as a critical guide for investors assessing the risk of their bond holdings.

Bonds are broadly categorized into two tiers based on their credit quality: investment-grade and high-yield, or “junk” bonds. The generally accepted dividing line is a rating of BBB- or higher by S&P or Fitch, or Baa3 or higher by Moody’s, which qualifies a bond as investment-grade. Bonds with ratings below this threshold are considered high-yield. The fundamental trade-off is clear: higher-rated bonds have a lower probability of default but offer a lower yield, while lower-rated bonds offer a higher yield to compensate investors for the increased risk.

While this trade-off seems straightforward, there is a more nuanced aspect to the risk profile of high-yield bonds. An analysis of historical data shows that default rates for BB-rated high-yield bonds have been “quite negligible” in recent years. This suggests that the primary risk for these bonds may not be the high probability of a default, but rather their heightened sensitivity to changes in interest rates, also known as duration risk, as well as liquidity risk. The prices of high-yield bonds can also be significantly more volatile than their investment-grade counterparts, with volatility sometimes more akin to stocks than to other bonds.

However, in a strong economy, rising interest rates can actually signal corporate health and potentially lower the risk of default for companies issuing these bonds. For investors with a higher risk tolerance, a carefully selected high-yield allocation may offer better returns, provided they understand and are prepared to navigate the liquidity and interest rate risks involved.

|

Feature |

Investment-Grade Bonds |

High-Yield Bonds (Junk) |

|---|---|---|

|

Credit Rating |

BBB- / Baa3 or higher |

Below BBB- / Baa3 |

|

Risk Profile |

Lower default risk |

Higher default risk |

|

Typical Yields |

Lower yields |

Higher yields to compensate for risk |

|

Price Volatility |

Lower volatility |

Significantly more volatile |

|

Portfolio Role |

Core stability, capital preservation |

Potential for higher returns; speculative |

5. Master Your Exposure to Shifting Interest Rates

A fundamental principle of bond investing is the inverse relationship between interest rates and bond prices. When prevailing interest rates rise, existing bonds that were issued at lower interest rates become less attractive to investors, causing their market prices to fall. This interest rate risk is a key consideration for any bond investor, but it can be proactively managed with strategic approaches.

Bond Laddering

Bond laddering is a widely used passive strategy that involves staggering the maturity dates of a portfolio of bonds. Instead of investing a lump sum in bonds that all mature at the same time, an investor purchases a series of bonds with different maturities, such as one-, three-, and five-year terms. This diversification across maturity dates ensures the investor avoids getting locked into a single interest rate.

As each bond matures, the principal is returned and can then be reinvested at the current prevailing rate. This not only helps smooth out the effects of interest rate fluctuations but also provides a continuous stream of liquidity and income.

A sample ladder could look like this:

The Barbell Strategy

This is a quasi-active strategy that provides a blend of both income and flexibility. An investor employing a barbell strategy purchases only short-term and long-term bonds, completely avoiding intermediate-term maturities. The long-term bonds allow the investor to lock in the typically higher interest rates available on longer maturities, while the short-term bonds provide a steady stream of liquidity. If interest rates rise, the principal from the maturing short-term bonds can be reinvested at the new, higher rates. Conversely, if rates fall, the long-term bonds continue to provide high-yield income.

The Bullet Strategy

This strategy is effective for investors who have a specific future financial need. It involves purchasing several bonds that are all timed to mature at the same specific date, such as when a college tuition bill comes due or when a down payment on a house is needed. By staggering the purchase dates of these bonds, an investor can mitigate the risk of buying all their bonds at a single, disadvantageous interest rate.

6. Avoid Common Myths and Debunk Outdated Assumptions

Successfully integrating corporate bonds into a portfolio requires moving beyond common misconceptions. An understanding of the true purpose and behavior of bonds is essential for making sound financial decisions.

- Myth #1: The purpose of fixed income is to produce income. While regular coupon payments are a key benefit, the primary role of bonds in a portfolio is not just income generation. They function as a stabilizing force, a shock absorber for market volatility, and a mechanism to keep pace with inflation and taxes. This stability provides the psychological confidence to resist panic-selling during a stock market downturn and to instead rebalance the portfolio by buying more equities at lower prices.

- Myth #2: Bonds always go up when stocks go down. This is perhaps the most prevalent and dangerous myth. As established, corporate bonds often exhibit a positive correlation with equities, meaning they tend to move in the same direction, though to a lesser degree. This is because both are tied to the financial health of the issuing company. This inverse relationship holds true for government bonds, which are considered a “safe haven” during periods of economic uncertainty, but not for all fixed-income securities.

- Myth #3: Holding a bond to maturity eliminates all interest rate risk. As previously discussed, holding a single bond to maturity protects against short-term price fluctuations and ensures the return of principal, barring default. However, it does not protect the investor from the opportunity cost of being locked into a lower interest rate, nor does it shield the investment’s real value from the corrosive effects of inflation on a fixed-income stream.

- Myth #4: Bonds always offer lower returns than stocks. Over the long term, stocks have indeed delivered dramatically higher nominal and real returns than bonds. However, this perspective overlooks the concept of risk-adjusted returns. Historically, bonds have provided better risk-adjusted returns than equities. A truly successful portfolio leverages the distinct roles of each asset class: equities for long-term growth and bonds for providing stability and resilience.

7. Build a Resilient, Long-Term Portfolio That Works for You

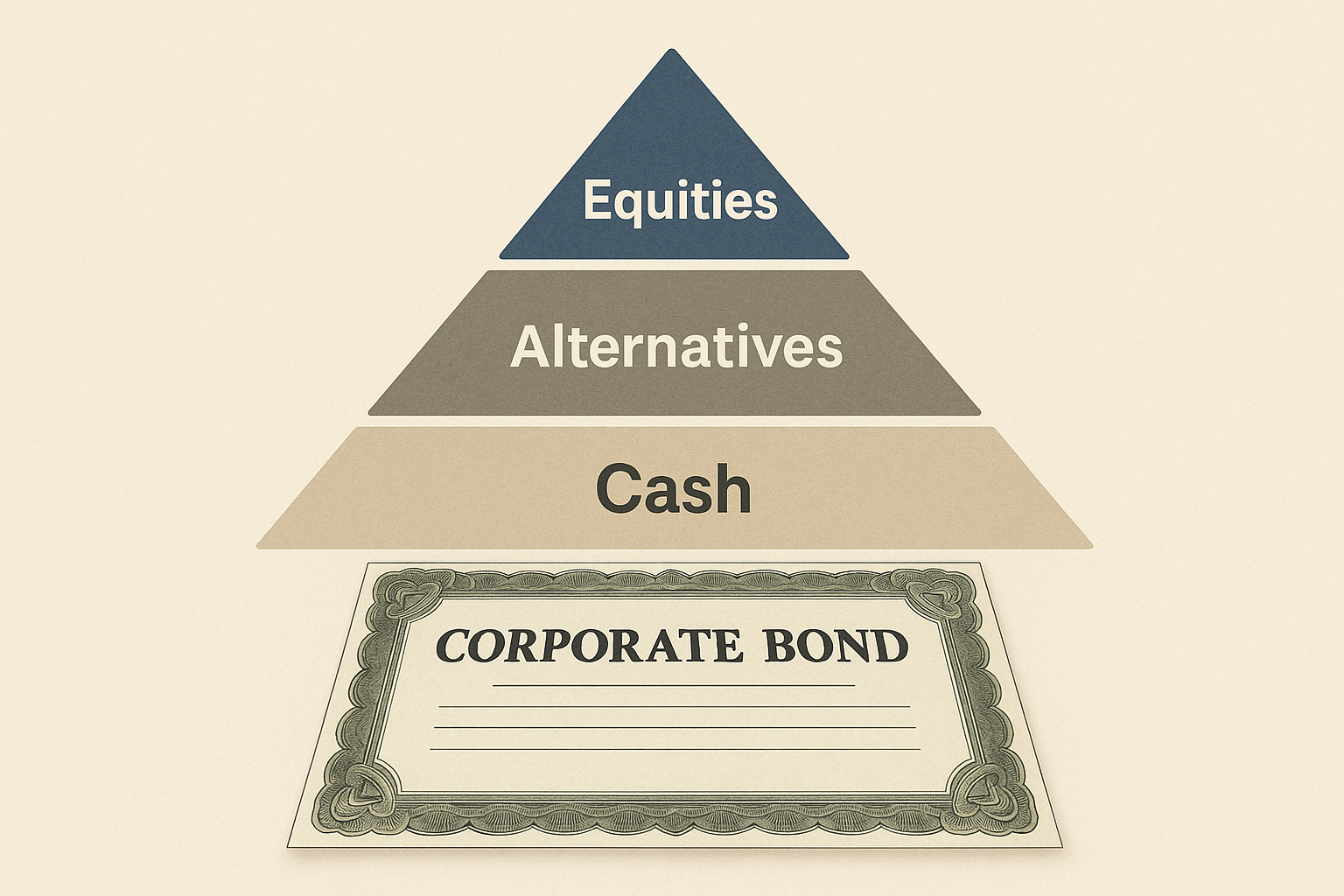

The ideal portfolio is not a one-size-fits-all formula. The most effective mix of equities, bonds, and cash depends entirely on an individual’s personal goals, investment time horizon, and unique risk tolerance. While a classic guideline suggests a 60% equities and 40% fixed-income allocation, this is a flexible starting point, not a rigid rule.

For investors ready to incorporate corporate bonds into their portfolios, there are several accessible options. Individual bonds can be purchased through a brokerage firm, a bank, or a bond trader. For those seeking professional management and broad diversification without the hassle of selecting individual bonds, investing in a pool of bonds through a bond mutual fund or an exchange-traded fund (ETF) is a straightforward alternative.

In conclusion, corporate bonds are not a simple “safe” alternative to stocks but a sophisticated and powerful tool. By understanding their true purpose, their complex risk profiles, and the strategic applications discussed in this guide, an investor can move past outdated myths and build a stable, income-producing portfolio designed for long-term financial resilience.

Your Most Pressing Questions Answered

- What is a corporate bond? A corporate bond is a debt security issued by a company to raise capital. When an investor buys one, they are lending money to the company in exchange for regular interest payments and the return of their principal at maturity.

- Are corporate bonds taxable? Yes, the interest earned on corporate bonds is generally taxed as ordinary income at the applicable federal and state income tax rates.

- Are corporate bonds better than Treasury bonds? It depends on an investor’s goals and risk tolerance. Corporate bonds offer higher potential yields but come with a greater risk of default. Treasury bonds have minimal credit risk because they are backed by the U.S. government, making them a “safe haven” but with lower returns.

- Are corporate bonds FDIC insured? No, corporate bonds are not insured by the FDIC. They are investment securities, not bank deposits.

- Can an investor lose money on bonds? Yes. An investor can lose money if a bond’s price falls due to rising interest rates and they are forced to sell before maturity. An investor can also lose money if the issuing company defaults on its payments.

- What is a bond ladder? A bond ladder is a portfolio strategy where an investor buys multiple bonds with staggered maturity dates. This approach helps manage interest rate risk and provides consistent income and liquidity as bonds mature and their principal can be reinvested.

- What is the historical performance of corporate bonds compared to stocks? Over the long term, stocks have historically delivered substantially higher returns than bonds, particularly when adjusted for inflation. However, bond returns have been less volatile. In rare market conditions, like in 2022, both stocks and corporate bonds have experienced significant declines in value.