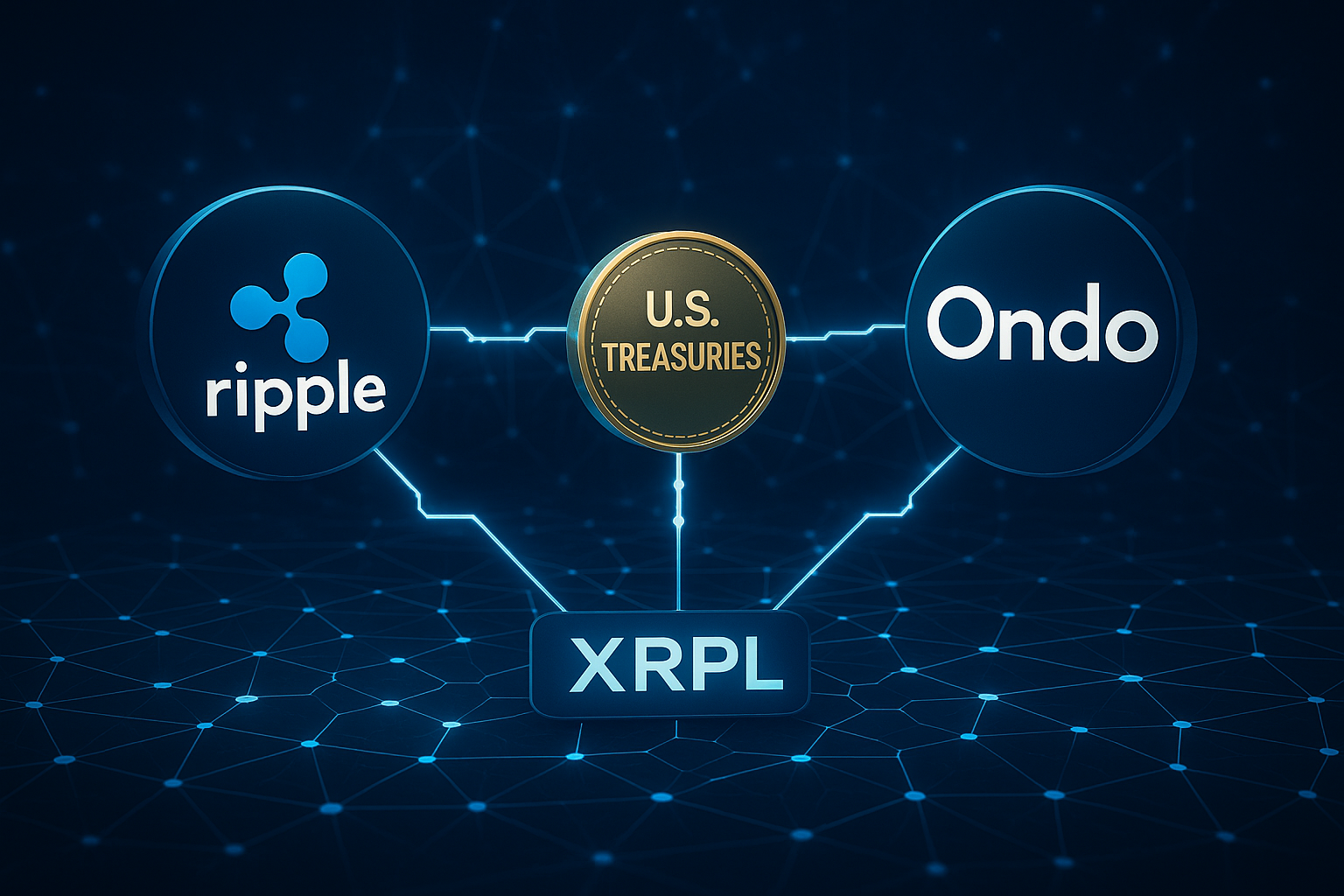

Ripple and Ondo Finance have joined forces to bring tokenized U.S. Treasuries to the XRP Ledger (XRPL). The partnership introduces Ondo’s Short-Term U.S. Government Bond Fund (OUSG), giving institutional investors 24/7 access to high-quality, on-chain financial assets. This initiative is powered by Ripple’s RLUSD stablecoin, enabling seamless minting and redemption around the clock. Together, the two firms aim to blend traditional finance with blockchain innovation, creating faster transactions and more efficient cash management. Ripple sees this collaboration as a crucial step toward making XRPL the go-to network for tokenized assets.

Ripple’s Vision: XRPL as the Hub for Tokenized Finance

Ripple’s long-term goal is clear — it wants XRPL to become the settlement layer for tokenized products like U.S. Treasuries. With upgrades to liquidity systems, programmability, and stablecoin infrastructure, XRPL is evolving into a secure, institution-ready platform. This latest move signals a growing trend in decentralized finance (DeFi): integrating real-world assets (RWAs) with blockchain for better transparency and efficiency. Ripple’s RLUSD stablecoin lies at the heart of this strategy, supporting instant settlement and compliance-focused operations. By merging stablecoin technology with U.S. Treasury tokenization, Ripple gives financial institutions new ways to manage portfolios with less friction and more flexibility.

Ripple and Ondo Bridge TradFi and DeFi

Ondo Finance brings deep expertise in real-world asset tokenization, boasting over $1.3 billion in total value locked. Its OUSG fund, now valued at more than $690 million, stands among the largest tokenized Treasury products, rivaling offerings from giants like BlackRock and Franklin Templeton. By launching OUSG on XRPL, Ondo provides institutional users with compliant, composable financial instruments that enhance liquidity and reduce settlement time. According to Ian De Bode, Chief Strategy Officer at Ondo, this integration expands access to “high-quality, on-chain financial instruments.” Ripple executives echo that sentiment, emphasizing how this collaboration strengthens the bridge between traditional finance (TradFi) and blockchain-powered DeFi.

Ondo Expands Tokenization Across Blockchains

Beyond XRPL, Ondo is building a multi-chain ecosystem for real-world assets. The firm plans to expand tokenization efforts to BNB Chain, Solana, and its own Ondo Chain, widening investor access to tokenized securities. Ondo’s Global Markets Platform already offers over 100 U.S. stocks and ETFs with 24/7 trading, reflecting its commitment to around-the-clock financial access. The company also aims to bring more than 1,000 U.S.-listed securities on-chain, from individual equities to fixed-income ETFs. Each tokenized asset mirrors its underlying liquidity, allowing investors to trade instantly with minimal slippage. Partnerships with wallets such as OKX Wallet, Trust Wallet, Ledger, and Bitget Wallet ensure broad accessibility and secure asset management.

XRPL and U.S. Treasuries: A New Era for Institutional DeFi

The arrival of U.S. Treasuries on XRPL marks a turning point for institutional DeFi. Ripple’s infrastructure provides speed, transparency, and compliance — all critical factors for professional investors. Tokenized Treasuries allow institutions to hold and manage government debt directly on-chain, improving both liquidity and operational efficiency. As global interest in digital assets rises, Ripple’s initiative sets a new standard for tokenized finance. With Ondo’s leadership in RWAs and Ripple’s robust settlement network, XRPL is emerging as a trusted home for tokenized U.S. Treasuries. Together, they’re proving that blockchain can deliver real-world value — not just speculation — and drive the next phase of financial innovation.