The Ultimate List of Innovative CD Deals for Savvy Savers

For decades, the traditional Certificate of Deposit (CD) has been a cornerstone of safe, low-risk savings. However, the modern financial landscape, characterized by volatile interest rates and inflation, demands a more dynamic approach. Today, traditional CDs, with their fixed terms and early withdrawal penalties, can feel restrictive, causing savers to fear being locked into a low-yield environment. Fortunately, a new generation of innovative CD deals and strategic savings methods has emerged, offering a powerful combination of predictable returns and greater flexibility. These five strategies are what savvy savers are leveraging to maximize their earnings and gain greater control over their financial future.

- The CD Ladder: The Master Strategy for Higher Returns & Unmatched Liquidity

- The No-Penalty CD: The Ultimate Safety Net for Uncertain Times

- The Bump-Up CD: The Secret Weapon in a Rising Rate Environment

- The Brokered CD: Unlocking Higher Yields and Greater Diversification

- The Smart Saver’s Playbook: A Current Market Analysis and Action Plan

Why Your Old CD Strategy is Leaving Money on the Table

For many, the appeal of a traditional CD has been its simplicity: a fixed rate of return in exchange for a fixed-term commitment. However, this “set it and forget it” approach has a significant drawback, particularly in a market with fluctuating interest rates. The core limitation of a traditional CD is the early withdrawal penalty, which can result in the loss of a portion of earned interest or even a part of the original principal if funds are needed before the maturity date. This creates an emotional dilemma for savers who want to earn more than a standard savings account, but worry about tying up their cash in an uncertain economic climate.

This fear of “locking up” money can cause savers to either settle for lower-yield savings accounts or miss out on competitive rates altogether. However, the financial industry has evolved, offering a suite of modern CD products and strategies designed to provide the benefits of a fixed-rate investment without the rigid constraints of the past. These new options empower savers to navigate market shifts, maintain access to their funds, and ultimately keep more of their money working for them. The following sections explore four of the most effective strategies that move beyond the limitations of a traditional CD.

The CD Ladder: The Master Strategy for Higher Returns & Unmatched Liquidity

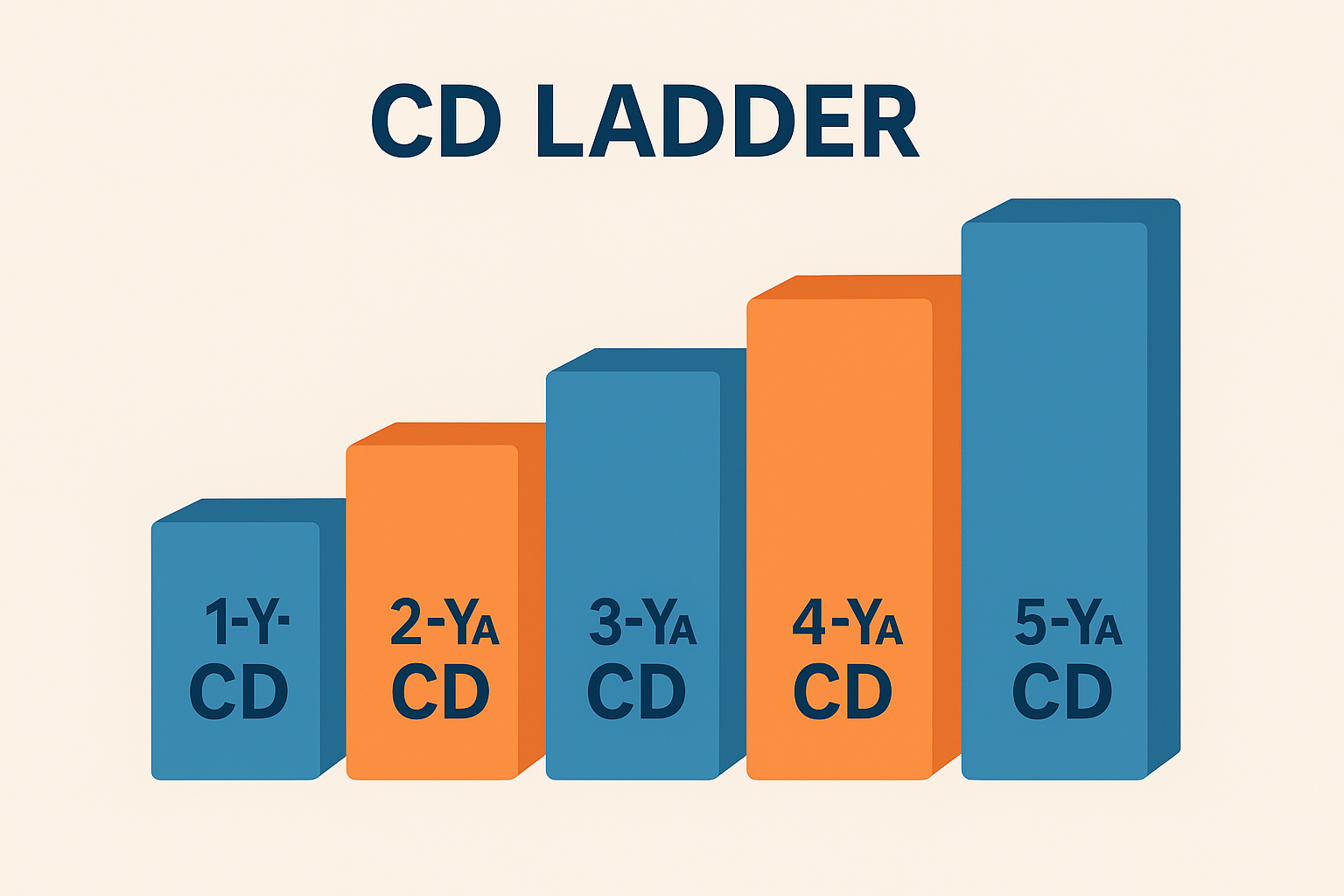

The CD ladder is a savings method that transforms the predictability of a CD into a sophisticated, flexible investment. It involves distributing a lump sum of money across multiple CDs with staggered maturity dates, creating a tiered portfolio that provides periodic access to funds. This approach is particularly popular among those who desire both the higher returns of long-term CDs and the periodic liquidity of short-term accounts.

How the CD Ladder Works

Building a CD ladder is a straightforward, step-by-step process. A common approach is to create a five-rung ladder. For example, a saver with $25,000 to invest could divide the funds equally into five separate CDs, each with a different maturity term: a one-year CD, a two-year CD, a three-year CD, a four-year CD, and a five-year CD.

As each CD matures, the funds—including both the principal and accrued interest—become available without penalty. The crucial second step of the strategy is to reinvest these funds into a new CD at the longest rung of the ladder, which in this example would be another five-year CD. Following this process, the saver will eventually have a portfolio of five five-year CDs, with one maturing each year.

Advantages of a CD Ladder

The primary benefit of this strategy is its ability to balance liquidity and yield. The CD ladder offers the higher interest rates typically associated with longer-term CDs while ensuring that a portion of the savings is accessible at regular, predictable intervals. This makes it an effective tool for managing planned expenses or providing a consistent cash flow.

Furthermore, a CD ladder acts as a powerful hedge against interest rate risk. If interest rates fall, the longer-term CDs in the ladder are already locked in at a higher rate, protecting the overall yield of the portfolio. Conversely, if rates rise, the maturing short-term CDs provide an opportunity to reinvest funds at the new, higher rates, ensuring the saver can take advantage of the improving market. This dual-purpose function of the CD ladder is its most valuable attribute, turning a common investment risk into a strategic advantage.

Disadvantages of a CD Ladder

While highly effective, the CD ladder is not without its drawbacks. The strategy requires diligent tracking of multiple maturity dates to avoid automatic rollovers, which could occur at unfavorable rates. Additionally, while it provides periodic access to funds, the money in each CD is still locked in until its specific maturity date, which can be an issue if an emergency arises. Lastly, in a high-inflation environment, the fixed rates of CDs may not keep pace with the rising cost of living, leading to a loss in purchasing power over time.

The No-Penalty CD: The Ultimate Safety Net for Uncertain Times

A no-penalty CD, also known as a liquid CD, is an innovative product that directly addresses the early withdrawal risk of a traditional CD. This type of account allows savers to withdraw their entire principal and all accrued interest before the maturity date without paying a fee. This unique feature provides an exceptional level of liquidity, making it a viable alternative to a high-yield savings account.

How a No-Penalty CD Works

The mechanics of a no-penalty CD are simple. A saver opens the account, locks in a fixed rate for a specific term (often around 11 to 14 months), and agrees to an initial waiting period, which is typically six to seven days after funding the account. After this period, the funds can be withdrawn at any time without penalty. This flexibility makes it a powerful tool for those with short-term savings goals or an emergency fund that requires a balance between security and accessibility.

Advantages of a No-Penalty CD

The key advantage of this product is its liquidity, providing a crucial safety net for unexpected expenses. Furthermore, no-penalty CDs offer a fixed interest rate, which can be a significant benefit in a declining-rate environment as it protects the saver’s yield from market fluctuations. The APY of a no-penalty CD is typically higher than what is offered by a traditional high-yield savings account, offering a better return on liquid cash.

Disadvantages of a No-Penalty CD

The trade-off for this flexibility is a lower rate compared to a traditional CD of the same term. The lower yield compensates the financial institution for the added flexibility it provides. A critical nuance of this product is that, in most cases, it does not allow for partial withdrawals. If a saver needs to access a portion of the funds, they are often required to withdraw the entire balance and close the account, which can limit its practical application. The funds are also not immediately accessible, requiring the initial waiting period before penalty-free withdrawals are permitted.

The Bump-Up CD: The Secret Weapon in a Rising Rate Environment

A bump-up CD, sometimes called a “raise-your-rate” CD, is designed for savers who believe interest rates may rise in the future. This product offers a fixed initial rate while providing the unique option to request a one-time interest rate increase if the bank raises its rates for that specific CD product during the term.

How a Bump-Up CD Works

The process is proactive and requires a keen eye on the market. A saver opens a bump-up CD, which starts with a set interest rate, usually for a two- or three-year term. If the issuing bank increases the APY for new bump-up CDs, the saver can contact the bank to “bump up” their own rate to the new, higher rate for the remainder of their term. Once the new rate is activated, it is fixed and will not decrease if rates fall again.

Advantages of a Bump-Up CD

The main advantage of a bump-up CD is its ability to capitalize on rising rates, a feature that a traditional CD cannot match. This provides a strategic opportunity for savers to potentially earn a higher return without having to incur a penalty or open a new account. The product offers a measure of rate protection with an upward potential, providing both stability and the chance for increased earnings.

Disadvantages of a Bump-Up CD

This strategic flexibility comes with a trade-off: a lower initial APY compared to a traditional CD of the same term. This means that if interest rates remain flat or decline, the bump-up CD may earn less over its term than a comparable traditional CD. The value of this product is dependent on the saver’s ability to time the market correctly. A saver who uses their single “bump” too early could miss out on a later, even higher rate increase. Furthermore, the responsibility to monitor rates and initiate the request lies with the saver, as the rate increase is not automatic. This makes the bump-up CD a tool for the engaged, proactive saver rather than the passive one.

The Brokered CD: Unlocking Higher Yields and Greater Diversification

A brokered CD is a type of CD that is purchased through a brokerage firm, rather than directly from a bank. These products are issued by a bank to be sold in bulk to brokerage firms, which then resell them to their customers. This model offers several unique features that appeal to savers seeking maximum yield and broader diversification.

How a Brokered CD Works

Brokered CDs are bought and sold on a secondary market, much like bonds. A saver can access offerings from numerous FDIC-insured banks through a single brokerage account, which simplifies management and provides diversification across institutions. Unlike a traditional CD, a brokered CD can be sold on this secondary market before its maturity date, providing a unique form of liquidity without an early withdrawal penalty.

Advantages of a Brokered CD

The primary advantage of a brokered CD is its potential for a higher APY compared to standard bank CDs. The competitive nature of the secondary market often drives yields higher. The ability to hold multiple CDs from different banks in one account simplifies the process of staying within FDIC insurance limits and provides greater convenience. The liquidity provided by the secondary market is a key differentiator, as it allows savers to access their funds before maturity without the fixed penalty of a traditional CD.

Disadvantages of a Brokered CD

While brokered CDs offer liquidity, it is not without risk. The value of a brokered CD on the secondary market fluctuates with prevailing interest rates. If a saver needs to sell their CD in a rising-rate environment, its market value would have declined, potentially resulting in a loss of the original principal. This is a crucial distinction from a no-penalty CD, where the principal is always guaranteed.

Another significant risk is that brokered CDs can be “callable”. This means the issuing bank has the right to redeem the CD before its maturity date, typically when interest rates are falling. If a CD is called, the saver is paid back the principal and earned interest up to that point, but is then forced to reinvest in a lower-rate environment, missing out on the full term’s earnings. Additionally, interest on brokered CDs is often simple rather than compounded, and intermediary fees may be incurred upon purchase.

The Smart Saver’s Playbook: Current Market Conditions & Strategic Moves

The current economic environment presents a unique opportunity for savvy savers. Following a period of significant rate hikes by the Federal Reserve in 2022 and 2023, which drove CD yields to highs not seen in years, the Fed has since begun a series of rate cuts in 2024 and 2025. This shift signals an environment where rates are expected to decline further in the near future.

For this reason, locking in a competitive, fixed rate now is a strategic move. Savers who wait may miss out on some of the last high yields available before they drop. While long-term CDs offer some of the highest rates, they can be a double-edged sword, as tying up cash for too long can create liquidity strains, especially with persistent inflation.

This is where the innovative strategies outlined above become invaluable. A CD ladder offers a way to secure a high, long-term rate while also building in periodic liquidity. A no-penalty CD provides a secure place for funds with a fixed rate that still outperforms many high-yield savings accounts, all with the safety net of penalty-free access. For those who can navigate the nuances, a brokered CD offers the potential for the highest yields available on the market.

Comparative Analysis: Finding the Perfect CD Deal

The choice of which innovative CD strategy to employ depends on a saver’s individual goals, risk tolerance, and current market outlook. A side-by-side comparison of the key features of each option can help clarify which is the best fit for a specific financial situation.

|

Feature |

CD Ladder |

No-Penalty CD |

Bump-Up CD |

Brokered CD |

|---|---|---|---|---|

|

Liquidity |

High (staggered access) |

High (penalty-free) |

Low (early withdrawal penalty) |

High (secondary market) |

|

Typical Rate |

Higher (long-term focus) |

Lower (trade-off for flexibility) |

Lower initial rate |

Often highest rates |

|

Primary Risk |

Tracking/Reinvestment |

Lower potential earnings |

Market timing, lower rate |

Market fluctuations, call risk |

|

Ideal Market |

Stable, Rising, or Falling |

Declining, Uncertain |

Rising |

Any (if held to maturity) |

|

Best For |

Balancing liquidity and yield |

Short-term goals |

Anticipating rate hikes |

Yield-focused investors |

Frequently Asked Questions (FAQ)

What is the difference between a Bump-Up and a Step-Up CD?

While the names are similar, the key difference lies in control. A bump-up CD gives the saver a one-time option to proactively request a rate increase if the bank’s rates rise. In contrast, a step-up CD has predetermined rate increases that occur automatically on a preset schedule, regardless of market conditions.

Are CDs still a good investment in 2025?

Yes. Despite the recent rate cuts from their late-2023 peak, competitive CD rates remain well above national averages and are still outpacing inflation. Locking in a fixed rate now can provide a significant advantage before rates potentially drop further, making CDs a smart component of a balanced savings strategy.

Is my money safe in an innovative CD?

Yes. All the strategies discussed rely on products that are issued by financial institutions and are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This insurance protects deposits up to $250,000 per depositor, per bank, including both principal and interest.

Can I add more money to a CD after I open it?

In most cases, a CD is funded with a single, one-time deposit and does not allow for additional contributions once the account is opened. However, some financial institutions offer a specific type of product known as an “add-on” CD, which does allow for subsequent deposits. Savers should always check the specific terms of their CD account before opening.

What is the difference between a CD and a high-yield savings account?

The primary distinction is the type of interest rate and the level of liquidity. A CD offers a fixed rate for a set term, providing predictable returns in exchange for limited liquidity. A high-yield savings account, on the other hand, offers a variable rate, which can fluctuate with the market, and provides full liquidity with no restrictions on withdrawals or additional deposits.