US Stock Market Stock Forecast

US Share Price Predictions with Smart Prognosis Chart - 2025-2026

You can find here the Best USA Stocks to buy!

Stocks are displayed based on their trading volume, showing the most actively traded securities first. This helps you identify stocks with high market interest and liquidity.

Showing 1-100 of 14,486 items.

| Rating | Name | Price | 7d Forecast | 3m Forecast | 1y Forecast | 5y Forecast | Price Graph (1y) |

|---|---|---|---|---|---|---|---|

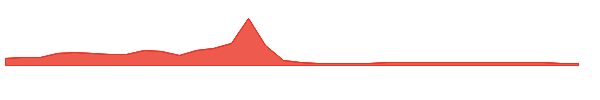

| A+ | Granite Construction Incorporated GVA | 109.17 | +1.96% | +8.13% | +11.75% | +78.07% |  |

| E | INLIF Limited INLF | 0.73 | +15.25% | -20.29% | -74.90% | -99.83% |  |

| A+ | Landstar System, Inc. LSTR | 122.02 | -0.41% | +10.79% | +25.50% | +23.45% |  |

| B+ | Meritage Homes Corporation MTH | 72.09 | -3.24% | -5.60% | -3.24% | +15.83% |  |

| A+ | Apogee Therapeutics, Inc. APGE | 39.66 | -1.51% | +0.55% | +50.02% | +300.95% |  |

| E | Artelo Biosciences, Inc. ARTL | 4.65 | +21.98% | +38.62% | -77.48% | -99.68% |  |

| A+ | Bitwise Crypto Industry Innovators ETF BITQ | 25.07 | -6.65% | -17.35% | -42.31% | -28.08% |  |

| A+ | Highland Funds I - Highland Income Fund HFRO | 6.37 | -1.76% | +12.75% | +32.22% | +69.39% |  |

| A+ | Avantis U.S. Equity ETF AVUS | 108.54 | +3.03% | +13.59% | +29.40% | +183.21% |  |

| A+ | JPMorgan Active Value ETF JAVA | 68.87 | +2.24% | +9.83% | +15.98% | +116.93% |  |

| B+ | Universal Display Corporation OLED | 143.19 | +9.58% | +17.88% | +12.75% | +44.16% |  |

| A+ | H.B. Fuller Company FUL | 58.90 | -1.66% | +0.09% | +24.82% | +33.77% |  |

| C | Cibus, Inc. CBUS | 1.29 | -16.46% | +5.26% | -78.19% | -99.93% |  |

| A+ | WIW | 8.89 | +1.02% | +6.79% | +15.44% | +29.45% |  |

| A+ | Parametric Hedged Equity ETF PHEQ | 31.99 | +0.49% | +6.54% | +20.17% | +142.21% |  |

| A+ | iShares MSCI South Africa ETF EZA | 63.85 | +1.64% | +26.32% | +39.47% | +140.75% |  |

| B+ | Anterix Inc. ATEX | 21.46 | +2.57% | +1.83% | +9.77% | -71.90% |  |

| A+ | EverQuote, Inc. EVER | 22.89 | -3.98% | +2.57% | -47.99% | -77.58% |  |

| A | URI | 953.37 | +0.98% | +16.76% | +31.70% | +276.22% |  |

| B+ | The India Fund, Inc. IFN | 14.64 | +1.54% | +14.81% | +35.39% | +111.64% |  |

| B+ | U-Haul Holding Company UHAL-B | 50.89 | +2.74% | -6.23% | +9.58% | +15.87% |  |

| B+ | Xponential Fitness, Inc. XPOF | 7.78 | -4.24% | -5.18% | +35.08% | +13.98% |  |

| A+ | Jackson Financial Inc. JXN | 101.02 | -1.04% | +27.59% | +33.69% | +526.43% |  |

| A+ | abrdn Global Premier Properties Fund AWP | 3.96 | -0.19% | +9.84% | +36.24% | +83.84% |  |

| A+ | MAIA Biotechnology, Inc. MAIA | 1.55 | -0.32% | -17.56% | -27.10% | -88.19% |  |

| A+ | Amplify Transformational Data Sharing ETF BLOK | 66.92 | +3.72% | +34.28% | +43.45% | +309.66% |  |

| A+ | Flowco Holdings Inc. FLOC | 14.73 | +6.51% | -7.40% | -33.83% | -88.92% |  |

| B+ | Hongli Group Inc. HLP | 1.32 | -24.34% | -7.20% | +6.93% | +4.71% |  |

| A+ | International Seaways, Inc. INSW | 46.00 | +1.02% | +1.66% | +23.59% | +234.29% |  |

| E | ProShares UltraShort Russell2000 TWM | 34.13 | -4.31% | -30.01% | -41.38% | -78.24% |  |

| A+ | Kulicke and Soffa Industries, Inc. KLIC | 40.48 | +7.32% | +28.13% | +61.32% | +137.28% |  |

| A+ | SandRidge Energy, Inc. SD | 11.27 | -0.48% | +20.31% | +96.73% | +433.69% |  |

| A+ | Invesco S&P MidCap Momentum ETF XMMO | 135.16 | +1.70% | +15.31% | +30.49% | +190.39% |  |

| A+ | Global X Cybersecurity ETF BUG | 35.15 | +6.26% | +17.41% | +41.64% | +161.62% |  |

| D | Alset EHome International Inc. AEI | 2.53 | -26.08% | -43.49% | -87.41% | -99.85% |  |

| A+ | Vicor Corporation VICR | 49.29 | +3.48% | +15.95% | +35.15% | +51.23% |  |

| B+ | Arrow Electronics, Inc. ARW | 120.49 | +1.02% | +12.79% | +36.05% | +101.27% |  |

| C | Leslie's, Inc. LESL | 5.53 | +14.70% | +29.80% | +13.41% | -98.34% |  |

| B+ | UFP Industries, Inc. UFPI | 93.20 | -1.62% | +8.58% | +27.45% | +93.87% |  |

| A+ | iShares Global Healthcare ETF IXJ | 88.75 | -1.63% | +1.03% | +7.81% | +46.16% |  |

| B+ | SCE Trust IV SCE-PJ | 23.59 | -0.71% | +5.71% | +5.92% | +32.83% |  |

| A | BKU | 37.99 | +5.69% | +28.73% | +57.58% | +184.72% |  |

| A+ | Virtus Dividend, Interest & Premium Strategy Fund NFJ | 12.97 | +2.77% | +11.76% | +28.79% | +114.48% |  |

| D | CXApp Inc. CXAI | 0.72 | +2.71% | -0.58% | +1.13% | -99.90% |  |

| A+ | G-III Apparel Group, Ltd. GIII | 26.51 | +2.38% | +19.82% | +17.90% | +146.58% |  |

| A+ | Alliance Resource Partners, L.P. ARLP | 25.22 | -2.67% | +26.66% | +62.23% | +705.46% |  |

| B+ | J&J Snack Foods Corp. JJSF | 96.04 | -2.05% | +5.19% | +5.10% | -15.20% |  |

| A+ | First Trust Long/Short Equity ETF FTLS | 69.87 | +1.32% | +5.93% | +15.14% | +93.65% |  |

| A+ | Kalaris Therapeutics Inc KLRS | 5.90 | -9.60% | -40.03% | -54.67% | -96.16% |  |

| A+ | Calavo Growers, Inc. CVGW | 25.59 | +5.03% | +10.87% | -23.44% | -64.20% |  |

| A+ | WisdomTree U.S. MidCap Dividend Fund DON | 52.18 | +0.01% | +9.78% | +26.81% | +113.06% |  |

| A+ | NYLI MacKay Muni Intermediate ETF MMIT | 24.26 | -0.41% | +1.49% | +0.31% | +3.07% |  |

| A+ | BRKRP | 270.50 | -4.48% | -4.15% | -8.06% | -19.36% |  |

| B+ | ANI Pharmaceuticals, Inc. ANIP | 92.42 | +2.53% | +6.06% | -3.02% | +101.92% |  |

| A+ | JOYY Inc. JOYY | 58.55 | +3.34% | +22.99% | -29.78% | -59.01% |  |

| B+ | Design Therapeutics, Inc. DSGN | 7.45 | -21.33% | -25.91% | -4.27% | -45.63% |  |

| A+ | BioLife Solutions, Inc. BLFS | 25.29 | -4.00% | +14.29% | +1.11% | +27.33% |  |

| A+ | BridgeBio Oncology Therapeutics Inc. BBOT | 11.62 | +2.26% | +13.74% | +96.11% | +2,896.94% |  |

| A+ | Fidelity MSCI Information Technology Index ETF FTEC | 221.57 | +2.74% | +11.74% | +38.77% | +306.76% |  |

| A+ | PDF Solutions, Inc. PDFS | 25.60 | +3.87% | +13.32% | +29.95% | +200.37% |  |

| A+ | Yalla Group Limited YALA | 7.52 | -5.28% | +9.09% | -53.31% | -84.13% |  |

| A+ | Innovative Solutions and Support, Inc. ISSC | 12.15 | -7.38% | -1.03% | +6.45% | -10.45% |  |

| A+ | ProShares Ultra 20+ Year Treasury UBT | 17.30 | -0.49% | -8.00% | -9.66% | -60.65% |  |

| A+ | Impinj, Inc. PI | 179.74 | +4.11% | +52.44% | +84.36% | +1,109.43% |  |

| B+ | Katapult Holdings, Inc. KPLT | 12.56 | +28.50% | +45.92% | -52.63% | -97.98% |  |

| A+ | SPDR S&P Aerospace & Defense ETF XAR | 234.28 | -1.53% | +8.05% | +12.83% | +137.61% |  |

| E | Rani Therapeutics Holdings, Inc. RANI | 0.49 | +10.18% | +61.99% | +19.21% | -92.22% |  |

| D | Predictive Oncology Inc. POAI | 13.91 | -89.80% | -89.93% | -95.13% | -99.94% |  |

| C | Compugen Ltd. CGEN | 1.48 | -6.14% | -13.87% | -64.96% | -99.23% |  |

| A+ | Qualys, Inc. QLYS | 132.48 | +4.34% | +7.89% | +20.56% | +96.60% |  |

| A+ | Kiniksa Pharmaceuticals, Ltd. KNSA | 38.62 | -1.40% | +18.20% | -7.89% | +27.12% |  |

| E | NetClass Technology Inc NTCL | 1.48 | +23.64% | +94.84% | -8.85% | -97.66% |  |

| B | GraniteShares 2x Long MSFT Daily ETF MSFL | 31.87 | -2.49% | +3.31% | +35.06% | +195.50% |  |

| A+ | Fidelity Covington Trust - Enhanced Small Cap ETF FESM | 36.38 | +1.34% | +9.08% | +12.92% | +137.18% |  |

| C | AGFiQ U.S. Market Neutral Anti-Beta Fund BTAL | 15.91 | -2.88% | -6.85% | -10.09% | -28.12% |  |

| B+ | HighPeak Energy, Inc. HPK | 6.91 | -11.01% | -14.04% | +8.22% | -8.51% |  |

| B+ | Simpson Manufacturing Co., Inc. SSD | 167.30 | +2.22% | +11.59% | +33.24% | +126.06% |  |

| A+ | Simplify MBS ETF MTBA | 50.36 | +0.41% | -0.11% | +3.31% | +22.82% |  |

| B+ | Septerna, Inc. SEPN | 18.58 | -16.85% | -21.80% | -3.26% | +366.26% |  |

| A+ | Alps Etf Trust - Alps/Smith Core Plus Bond ETF SMTH | 26.14 | +1.17% | +1.12% | +5.66% | +33.29% |  |

| B+ | Atlanta Braves Holdings, Inc. BATRK | 41.61 | -0.12% | +10.32% | +6.74% | +54.91% |  |

| A+ | ConnectOne Bancorp, Inc. CNOB | 24.83 | +4.48% | +22.17% | +57.90% | +92.61% |  |

| A+ | CORZZ | 17.90 | +11.17% | +11.48% | +99.71% | +2,436.75% |  |

| B+ | Hamilton Lane Incorporated HLNE | 134.70 | +6.07% | +14.60% | +14.28% | +80.18% |  |

| A+ | John Hancock Multifactor Mid Cap ETF JHMM | 64.59 | +1.51% | +13.49% | +28.42% | +117.69% |  |

| E | Direxion Daily META Bear 1X ETF METD | 14.53 | -5.21% | -16.08% | -18.09% | -55.17% |  |

| A+ | Critical Metals Corp. CRMLW | 2.05 | +11.78% | +78.98% | +126.95% | +3,578.86% |  |

| E | Kuke Music Holding Limited KUKE | 0.59 | +14.32% | -26.32% | -59.98% | -98.55% |  |

| A+ | U.S. Gold Corp. USAU | 16.26 | -3.36% | +8.29% | -10.47% | -75.03% |  |

| A+ | Capital Group International Equ CGIE | 33.75 | -0.25% | +6.88% | +24.17% | +183.40% |  |

| A+ | Crescent Capital BDC, Inc. CCAP | 14.19 | +3.69% | +15.79% | +34.86% | +117.09% |  |

| A+ | CHI | 10.74 | +2.35% | +14.79% | +14.64% | +42.96% |  |

| B+ | National Beverage Corp. FIZZ | 36.84 | +10.67% | +15.01% | -0.44% | -4.30% |  |

| A+ | JPMorgan Chase & Co. JPM-PL | 20.33 | +3.77% | +5.62% | -5.58% | -5.72% |  |

| A+ | BlackRock Enhanced Global Dividend Trust BOE | 11.55 | +1.43% | +8.04% | +20.32% | +89.57% |  |

| B | RIV | 11.96 | +0.20% | +13.90% | +30.48% | +110.07% |  |

| A+ | Acushnet Holdings Corp. GOLF | 78.26 | -0.71% | +13.61% | +2.98% | +89.74% |  |

| A+ | EastGroup Properties, Inc. EGP | 168.83 | +2.13% | +11.23% | +19.21% | +52.94% |  |

| E | SOS Limited SOS | 1.89 | +31.88% | +45.13% | -71.96% | -99.96% |  |

| B | LB Pharmaceuticals Inc Common Stock LBRX | 15.26 | +1,000.00% | +1,000.00% | +1,000.00% | +1,000.00% |  |

Stock Price Forecast and Prognosis

Trading Stock Markets means that you are trying to beat automated software solution and professionals who are involved with the biggest companies on a global scale. It involves a lot of uncertainty and a lot of different variables need to be kept in mind. These markets might see a lot of volatility as the world is changing around them and new competitors are surfacing.

We are confident that we can manage to give you proper help in these markets as we have already managed to gain experience in several fundamentally different areas like the Forex, Commodity and Cryptocurrency markets. A positive aspect is that these traditional market types have usually years of previous trading and volatility data available, meaning that we have the opportunity to use our existing prediction software and we can feed it enough market data to offer you a valuable perspective while trying to figure out market movements. We offer forecasts on every popular Stock market that you might need and we are always open for further suggestions from our users. We feed our Machine Learning (AI based) forecast algorithm data from the most influential global exchanges.

There are a number of existing AI-based platforms that try to predict the future of Stock markets. They include data research on historical volume, price movements, latest trends and compare it with the real-time performance of the market. WalletInvestor is one of these AI-based price predictors for the Forex and metal that appears quite promising. Due to the fluctuations of the market, relying on predictions alone is not considered a viable option at all. If you are looking for an easy-fix solution and price prediction, you are placing your considerable investments at higher risk. You can use the predictors to make an educated guess about the future of the these markets, but also keep the latest news, global impacts and fundamentals always in mind when investing.

With the data gained from our website and your own fundamental research you can start building a portfolio. Consider this as a place to kick-start your research. These markets can sometimes be hard to get around and to predict, learning curves can take up to several years if you have no outside help and want to rely solely on your own learning ability and hindsight. This is the reason that you should build up a learning methodology and bookmark several sources of information that are always up-to-date with the markets you are researching. We at WalletInvestor are constantly recalculating forecasts as present market data arrives into our system.